Insurance for the Healthcare industry

Why choose Zurich for Healthcare industry insurance?

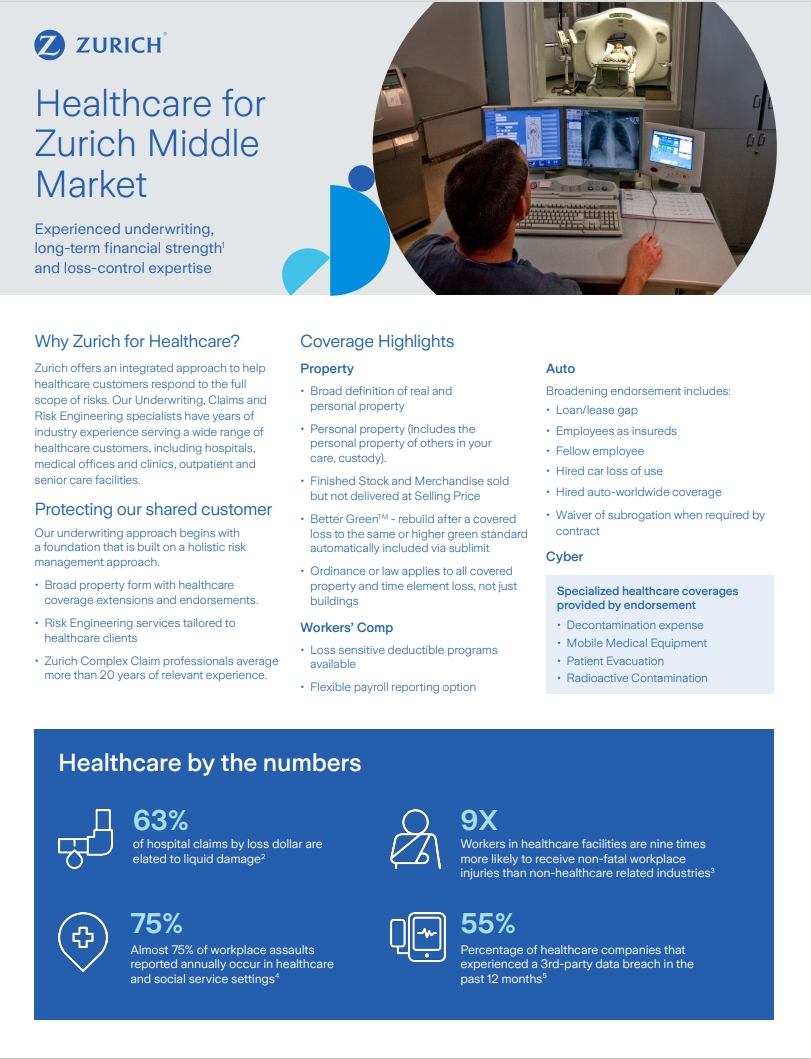

Zurich offers an integrated approach to help healthcare businesses respond to the full scope of risks. Our Underwriting, Claims and Risk Engineering specialists have years of industry experience serving a wide range of healthcare customers, including hospitals, medical clinics, and senior care providers.

We offer:

- Experienced underwriters

- A consultative approach to help identify risks and provide the right mitigation plan

- Flexible and specialized coverages designed for healthcare facilities

- Robust Risk Engineering capabilities

Targeted classes for Healthcare

- Hospitals

- Medical clinics and offices

- Medical laboratories

- Outpatient facilities and services

- Skilled nursing facilities

- Telehealth

Healthcare resources

Insurance solutions for Healthcare companies

An industry-leading property form built for the middle market customer, Zurich’s Property Portfolio Protection form provides broad and flexible coverage with simplified language.

- Real property does not exclude insureds interest in:

- Underground pipes, flues, drains and foundations of buildings, machinery or boilers

- Paved surface

- Personal property includes:

- Personal property of others in your care, custody

- Finished Stock and Merchandise sold but not delivered at Selling Price

- Better GreenTM – coverage to rebuild to the same or higher green standard automatically included via sublimit after a covered loss

- Worldwide Mobile Communications Property

- Flexible Accounts Receivables, Valuable Papers, Computer Systems

- Combined Business Income and Extra Expense Form with no deductible for Extra Expense

- Flexible Extended Period of Indemnity options

- Unscheduled Locations time element coverage sublimit included in base Business Income with Extra Expense Form

- Ordinance or Law applies to all covered property and time element loss, not just buildings

For customers with larger and more complex risks, Zurich Edge II is built to be broadly customizable. and offers two proprietary “all-risk” healthcare forms:

- Zurich Edge II Domestic Healthcare

- Zurich Edge II Global Healthcare

Both forms are written in easy-to-understand language and simplified formatting, with the flexibility customers have come to expect from Zurich.

Auto coverage to protect against third-party liability and property damage for owned fleets and non-owned and hired vehicles. Broadening endorsements include:

- Loan / lease gap

- Employees as insureds

- Fellow employee

- Hired car loss of use

- Hired auto-worldwide coverage

- Waiver of subrogation when required by contract

Zurich provides options designed to get your workforce back to work quickly and safely.

- Loss-sensitive deductible programs available

- Flexible payroll reporting options

Zurich’s Cyber Insurance Policy helps address the cyber risks customers face. Our product helps customers respond rapidly to the impacts of cyber attacks, with advice and help from dedicated cyber risk professionals.

In addition to the many traditional insurance coverages needed by most businesses, Zurich can provide specialized insurance coverages tailored to the needs of healthcare facilities, including:

- Decontamination Expense

- Mobile Medical Equipment

- Patient Evacuation

- Radioactive Contamination

Meet our Healthcare industry specialist

Bill Fahy

Head of Private Equity, General and Developing Industries

U.S. Middle Market

william.fahy@zurichna.com

Ready to do business, but don't have a broker? Find a broker

Risk Engineering

Through Zurich Resilience Solutions (ZRS), we provide specialized insights and tools to support our customers with solutions addressing traditional and evolving risks – above and beyond insurance.

Learn more

Claims Services

Zurich Claims specialists are strategically deployed in the U.S. and around the globe to help customers mitigate and respond to loss events, and to gain insights into becoming more resilient against future losses.

Learn moreFAQs

Healthcare industry companies that should consider commercial insurance for protection include:

|

|