Insurance for construction companies and businesses

Why choose Zurich for construction insurance

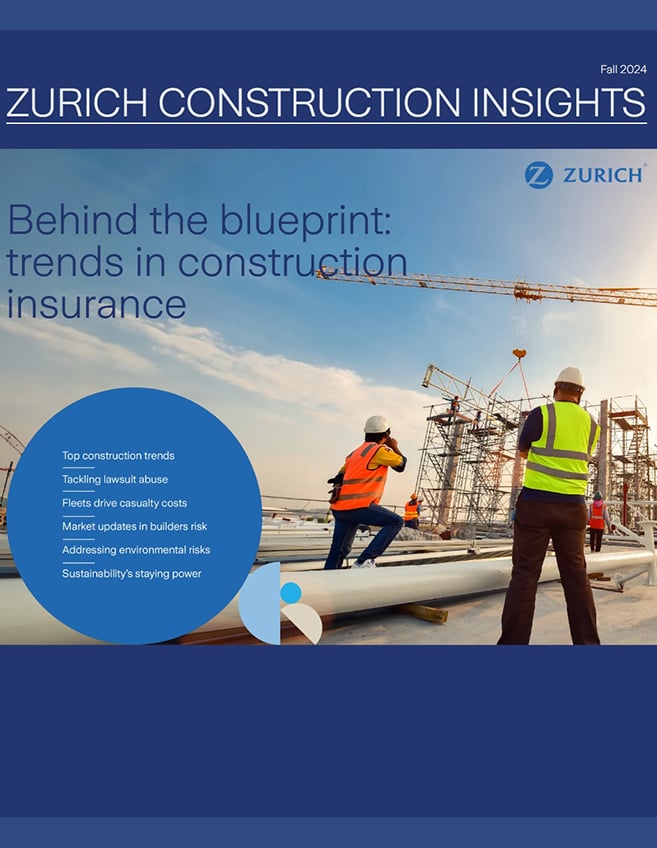

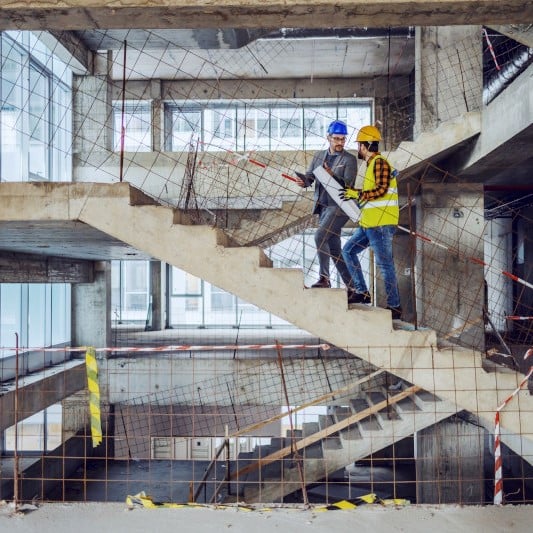

Labor shortages, severe weather and increasing use of technology are just a few of the forces complicating construction risk management today. Contractors and project managers need to be aware of all job site risks, including theft, job site injuries, property damage and work vehicle losses. Zurich provides customized solutions for midsize to large commercial construction projects through monoline and multiline insurance programs.

Building a Secure Foundation for Your Projects

Zurich provides foundational construction insurance solutions designed to help you build with confidence. With decades of experience, we understand that every project has a unique risk profile. We work with you to tailor a broad suite of coverages, because your focus should be on the job site, not on the "what ifs."

Our core offerings are designed to address the most common exposures in the construction industry:

- Builder's Risk Insurance: A critical coverage that helps protect your projects from start to finish, covering property damage due to fire, wind, and other covered perils.

- Casualty Insurance for Construction Companies: This helps safeguard your business from third-party claims of bodily injury or property damage that can arise from your operations.

- Workers' Compensation: A vital component of any construction business, providing benefits to employees for work-related injuries or illnesses.

- Commercial Auto Insurance: Helps cover your fleet of vehicles, from trucks to vans, that are essential to your daily operations.

We believe in a collaborative approach to managing your risks. Let's work together to build a more resilient future for your business.

Ready to lay the groundwork for a more secure project? Contact your broker, or find a Zurich preferred broker today.

Zurich Construction Leadership Directory

Strategic Solutions for Complex Construction Risks

For large-scale and complex projects, a standard construction insurance program is not enough. Effective construction risk management requires a sophisticated approach. Leveraging our global network and capabilities, Zurich delivers specialized and project-specific coverages designed for the intricate demands of large corporate construction.

We collaborate with you to develop solutions that address your unique risk profile:

- Wrap-Up Liability Programs (OCIP/CCIP): For large projects, an Owner-Controlled Insurance Program (OCIP) or Contractor-Controlled Insurance Program (CCIP) can provide a more streamlined approach to liability coverage for all enrolled contractors and subcontractors.

- Surety Bonds: We are a leading provider of surety bonds, offering the financial backing to support your contractual obligations and commitments.

- Contractors Pollution Liability: This coverage is designed to address the risks of pollution incidents that can arise from your construction activities.

- Professional Indemnity: Helps protect against claims of negligence or errors and omissions in the professional services you provide.

Our experienced team is ready to work with you on your most ambitious projects, from infrastructure to large-scale commercial developments. We provide the strength and stability you need to take on new challenges.

Let's build a strategy for your next landmark project. Schedule a consultation with your broker or find a Zurich preferred broker today.

Zurich Construction Leadership Directory

As one of the leading insurance carriers in the construction industry, our mission is to provide creative solutions for the risks our customers face today and in the future by providing a broad array of distinctive products and services, we work to help limit the cost of risk while helping to increase job site safety awareness.

Zurich Construction’s experienced leadership team is ready to work with you to help ensure your business risk management needs are met.

Collaborating to Enhance Safety and Manage Claims

Our commitment to your success extends beyond construction insurance policies. We believe in a proactive, hands-on approach to construction risk engineering and claims management. We work with you to identify potential hazards and develop strategies designed to improve jobsite safety and help reduce construction claims.

Our dedicated Risk Engineering team provides a limited advisory function, offering services such as:

- On-site assessments to identify potential risks and areas for improvement.

- Safety program reviews to help you strengthen your existing safety protocols.

- Training and education on a variety of construction-related safety topics.

When a claim does occur, our construction claims handling team is ready to respond. With a customer satisfaction rating of over 90%1, our claims specialists are dedicated to a fair and timely resolution process. We understand the urgency of getting you back to work, and we are committed to helping you navigate the claims process with clarity and confidence.

Let's work together to build a safer, more resilient operation. Meet the Zurich Construction team to learn more about our risk management services.

1. Zurich's 2024 Post-Claim Survey

Risk Engineering

Through Zurich Resilience Solutions (ZRS), we provide specialized insights and tools to support our customers with solutions addressing traditional and evolving risks – above and beyond insurance.

Learn more

Claims Services

Zurich Claims specialists are strategically deployed in the U.S. and around the globe to help customers mitigate and respond to loss events, and to gain insights into becoming more resilient against future losses.

Learn moreFAQs

Construction insurance protects businesses involved in building projects by covering risks such as physical loss or damage to structures and materials during construction (builder’s risk), third-party injury or property damage (general liability), professional errors in design (professional indemnity), employee injuries (employer’s liability), pollution or environmental incidents, and loss or damage to equipment and machinery. It can also include surety and performance bonds to guarantee contractual obligations, and optional covers like delay in start-up, terrorism, or contractor’s pollution liability, providing comprehensive protection and reducing financial uncertainty for contractors, project owners, and other construction stakeholders.