Insurance for Restaurants

Why choose Zurich for Restaurant insurance?

Restaurants are evolving their dining experience to meet shifting consumer expectations. This includes renovating kitchens and dining rooms while integrating new technologies and introducing new product lines. Zurich has the knowledge, products and services needed to help you navigate the risks associated with your evolution.

Targeted classes for Restaurants

- Fine Dining

- Farm to table

- Upscale Casual

- Contemporary Casual

- Fast Casual

- Bistro

- Breakfast & Lunch Café

Restaurant resources

Insurance solutions for Restaurants

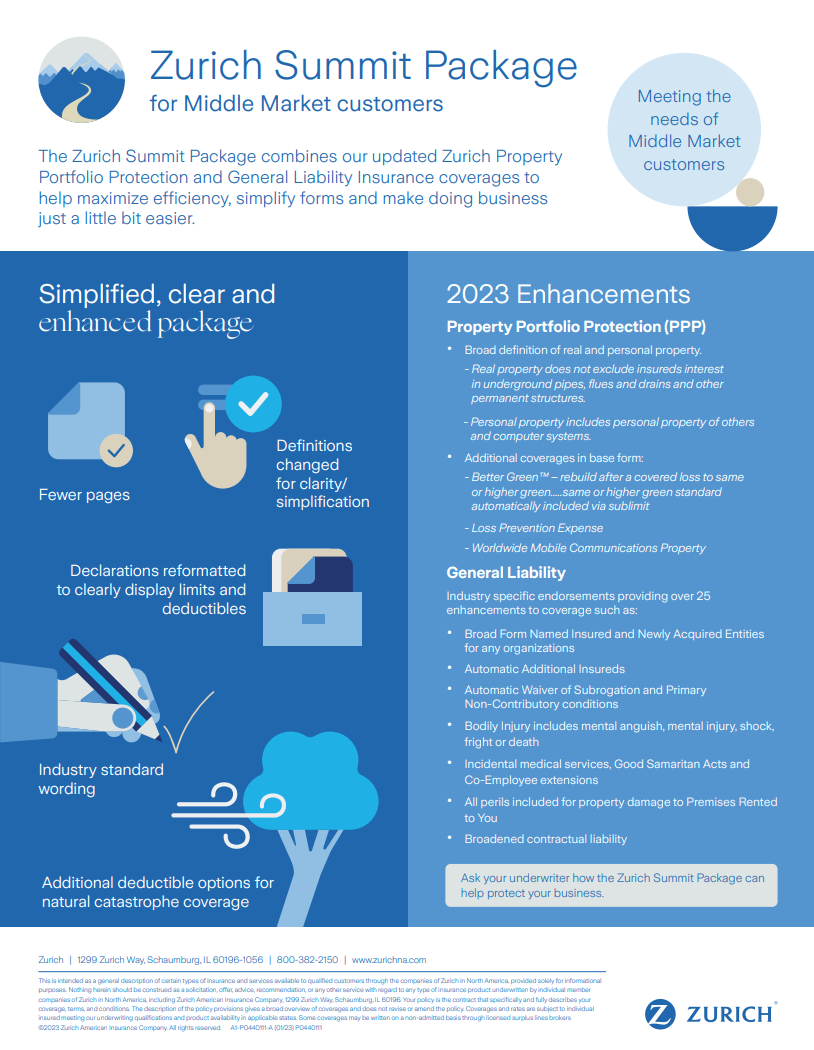

Broad definition of real and personal property.

- Real property does not exclude insureds interest in underground pipes, flues, drains and other permanent structures.

- Personal property includes personal property of others and computer systems.

- Equipment breakdown coverage included with no sub-limit.

- Ordinance or law applies to all covered property and time element loss, not just buildings

- Better GreenTM – coverage to rebuild to same or higher green standard

- Flexible Accounts Receivables, Valuable Papers, Computer Systems and Fine Arts limits

- Hospitality and Leisure Industries Coverage Endorsement Enhancement provides additional coverage for Customer Inconvenience, Guest Property, Lost Master Key, Food Contamination for Business Income and Extra Expense

- Rare Wine and Distilled Spirits Valuation enhancement amends valuation for rare bottled wines and spirits to selling price per bottle or per pour.

General Liability Industry specific endorsements providing 22 enhancements to coverage such as:

- Broad Named Insured

- Automatic Blanket Additional Insureds

- Automatic Waiver of Right of Subrogation and Primary Non-contributory conditions

- Incidental Medical Services, Good Samaritan Acts and Co-Employee extensions

- Broadened perils included for Property Damage to Premises Rented to You

- Definition of Bodily Injury includes mental anguish, mental injury, shock, fright or death

- Broadened contractual liability

Liquor Liability coverage available

Broadening coverage endorsement adds 23 extensions in one form, including:

- Employees as insureds

- Waiver of Subrogation (when required by contract)

- Fellow employee

- Hired car loss of use

- Hired Auto world-wide coverage

Garage keepers coverage available for valet exposure

- Level and variable dividend options available.

- Loss sensitive programs available.

- Pay-as-you-go payroll options.

In addition to the many traditional insurance coverages needed by most businesses, Zurich can provide specialized insurance coverages tailored to the needs of restaurants, including:

- D&O

- E&O/Professional Liability

- Cyber

- Garagekeepers liability

Risk Engineering

Through Zurich Resilience Solutions (ZRS), we provide specialized insights and tools to support our customers with solutions addressing traditional and evolving risks – above and beyond insurance.

Learn more

Claims Services

Zurich Claims specialists are strategically deployed in the U.S. and around the globe to help customers mitigate and respond to loss events, and to gain insights into becoming more resilient against future losses.

Learn moreFAQs

Restaurant owners face unique risks, from kitchen fires to customer injuries. Without adequate insurance coverage, these incidents can lead to significant financial losses, legal liabilities, and even business closure. Comprehensive restaurant insurance provides the peace of mind that comes with knowing that your business, employees, and patrons are protected. It's an investment in the sustainability and resilience of your food business.

Zurich’s appetite is fine dining, farm to table, upscale casual, contemporary casual, fast casual, bistro, and breakfast & lunch café.