Employee Benefit Solutions

Why choose Zurich for supplemental benefit insurance?

The strength of Zurich’s Employee Benefit Solutions goes far beyond policy details. We offer a dedicated support team for coordination of plan development, marketing, administration onboarding, and program management. We provide you with a single point of contact, as well as administration that details processes, forms, and group/individual contact information. We’ll work with you to help simplify the administration of your program and we’re always ready to answer questions to help address your needs and those of your employees.

At Zurich, our customers' needs remain at the heart of everything we do.

Resources

Want to learn more?

Connect with our Customer Inquiry Center for more information.

FAQs

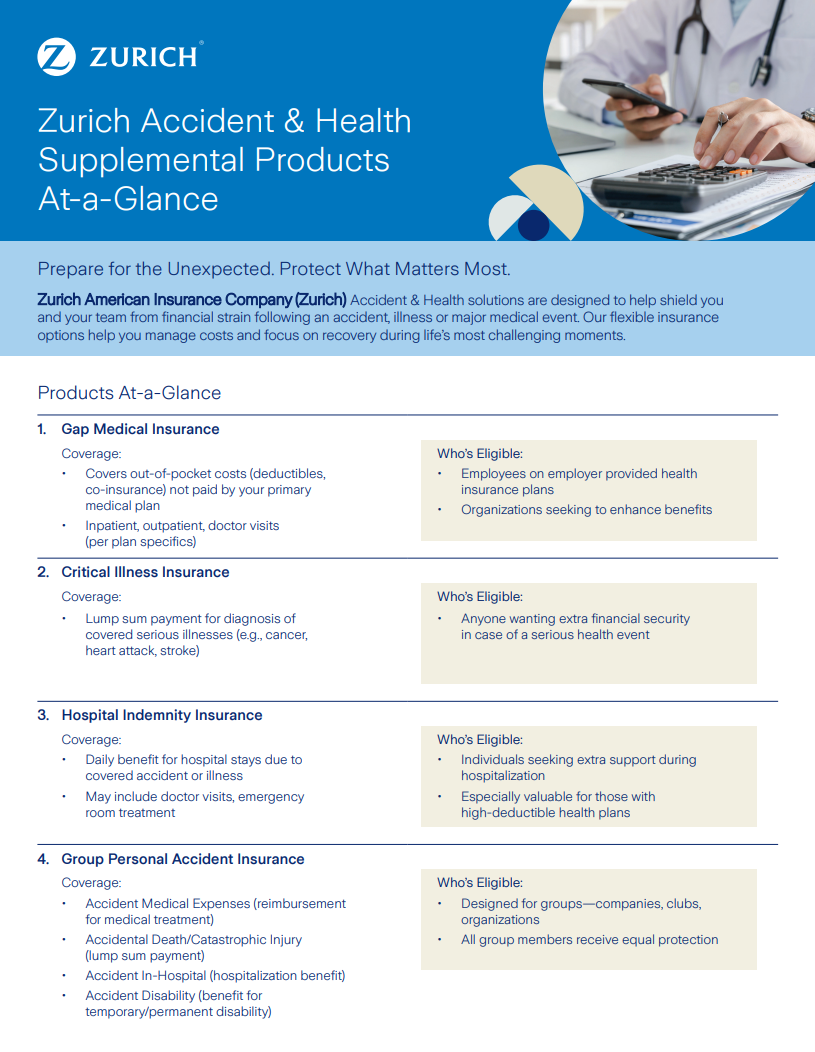

Zurich Employee Benefit Solutions are supplemental benefit insurance coverages (such as Hospital Indemnity, Group Personal Accident, Supplemental Gap Medical, Critical Illness, and Travel Protection and Business Travel Accident Insurance) that can be affordable options to help employees manage sudden, substantial out-of-pocket costs in an era of high deductibles and co-pays.

Zurich Employee Benefit Solutions offer businesses the flexibility to choose customizable health-related coverage options that offer workers a financial safety net for a range of illnesses and injuries with no restrictions on how the payout is used.

The so-called “Great Resignation” may have been jump-started by COVID-19, but most of the issues related to this tightening of the labor market are not pandemic-specific. In a Pew Research Center survey, 43% of respondents cited a dissatisfaction with benefits as a reason for leaving their jobs.2 As workers face rising out-of-pocket healthcare costs, the option of a supplemental insurance offering to help them manage those costs can be a very attractive incentive to join or stay with a company.

Zurich Employee Benefit Solutions can help ease stress and worry, allowing employees to perform at their full potential. A strong benefits package shows current and potential future employees that the company is investing in their health…and their future. In short, both employers and employees can benefit from a supplemental benefits plan.

1. Wooldridge, S. “Voluntary benefits: How they’ve become a must-have product for brokers.” BenefitsPRO. 28 June 2018.

2.Parker, Kim, and Juliana Menasce Horowitz. “Majority of workers who quit a job in 2021 cite low pay, no opportunities for advancement, feeling disrespected.” Pew Research Center. 9 March 2022.

3.Based on Zurich North America Closed Claims Net Promoter Score of 85 for 2021. Top Quartile TNPS threshold for insurance industry: 57 (2021). Source: Medallia.