Supplemental Gap Medical Insurance

Why choose Zurich for Supplemental gap medical insurance

The strength of Zurich’s Supplemental Gap Medical Insurance goes far beyond policy details. We offer a dedicated support team for coordination of plan development, marketing, administration onboarding, and program management. We provide you with a single point of contact, as well as administration that details processes, forms, and group/individual contact information. We’ll work with you to help simplify the administration of your program and we’re always ready to answer questions to help address your needs and those of your employees.

At Zurich, our customers' needs remain the heart of everything we do.

Related insurance offerings

Resources

Supplemental gap medical insurance options

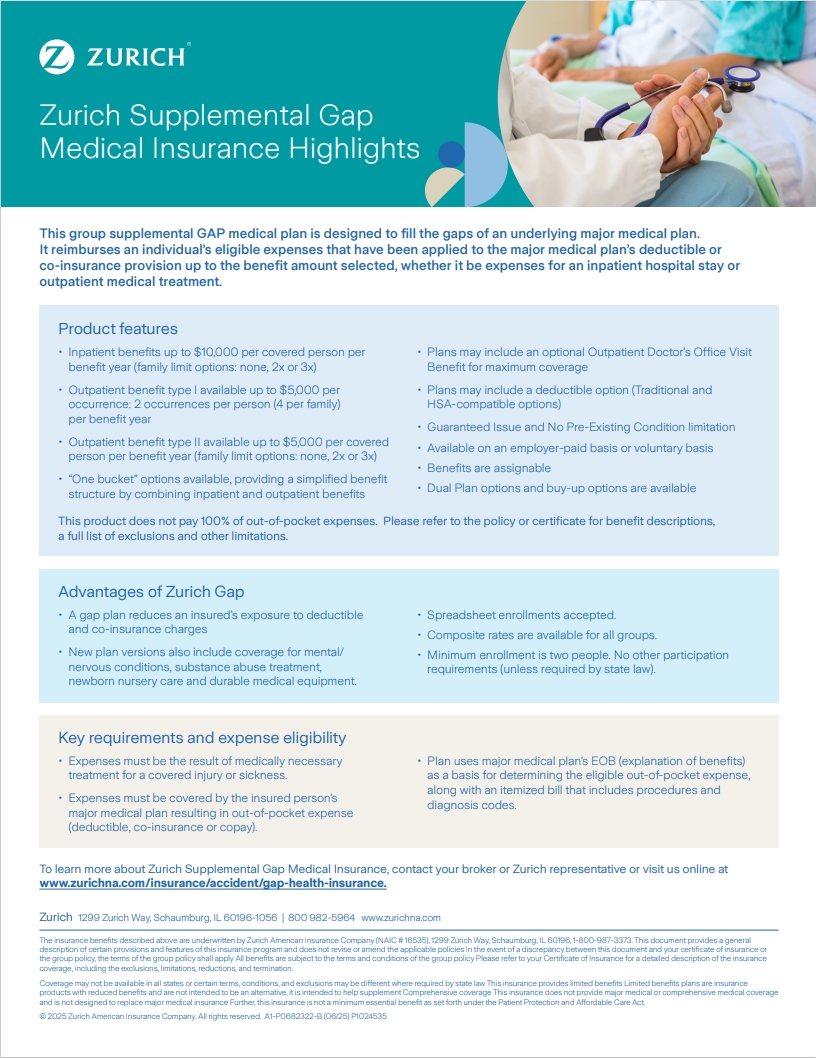

Our supplemental gap medical insurance plans are flexible and can be customized to meet the specific needs of each employer group. We have the capability to work within a wide range of benefits administration platforms, whether managed by a broker or vendor. Our Underwriters can customize group-priced benefit solutions for your organization.

Want to learn more?

Connect with our Customer Inquiry Center for more information.

FAQs

- Benefits are paid directly to the medical service provider. Claim forms are not necessary in most cases when an assignment of benefits exists.

- Employers can choose a variety of coverage options, including varied inpatient and outpatient benefits. Deductibles can be added to the plan to manage premium costs.

- For employer-paid, voluntary, and dependent buy-up options, monthly premiums can be based on the employee’s attained age or a composite rating for the group can be provided.

- Coverage can be configured to be compatible with high-deductible health plans using health savings accounts.*

*Some product configurations may not be compatible with high-deductible health plans involving a tax-advantaged health savings account (HSA).