Excess and Primary Casualty Insurance with Zurich E&S

Solutions for Wholesale Distributors

Why Choose Zurich E&S Casualty Insurance?

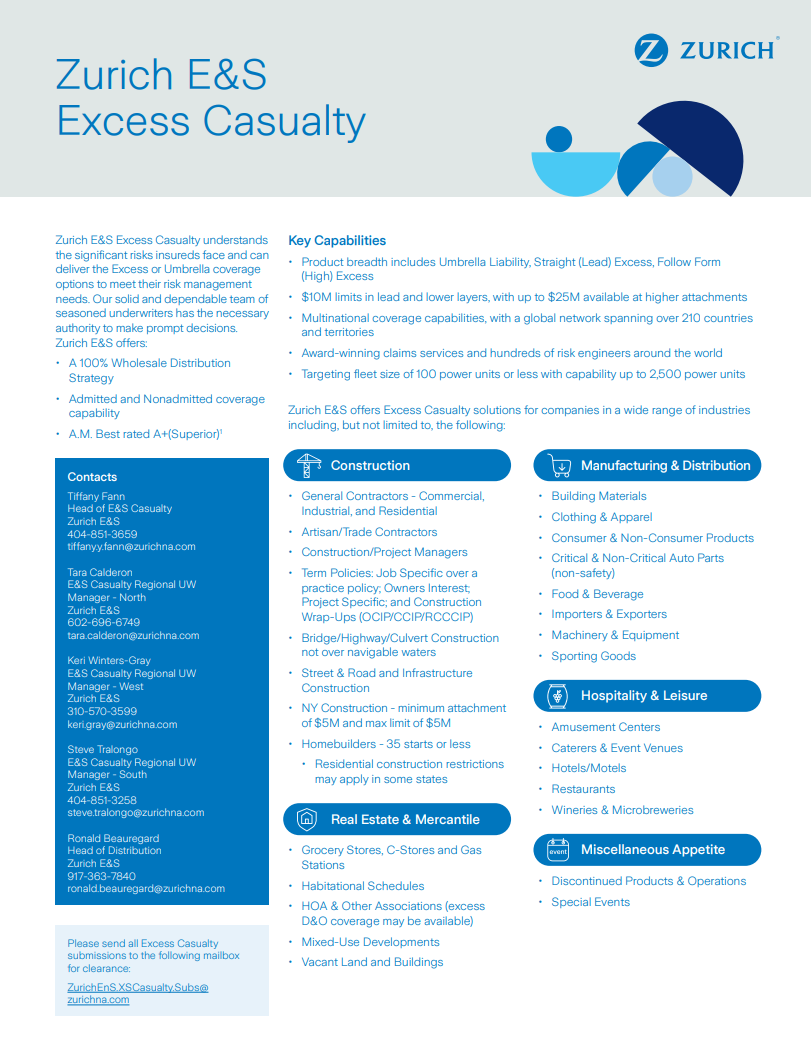

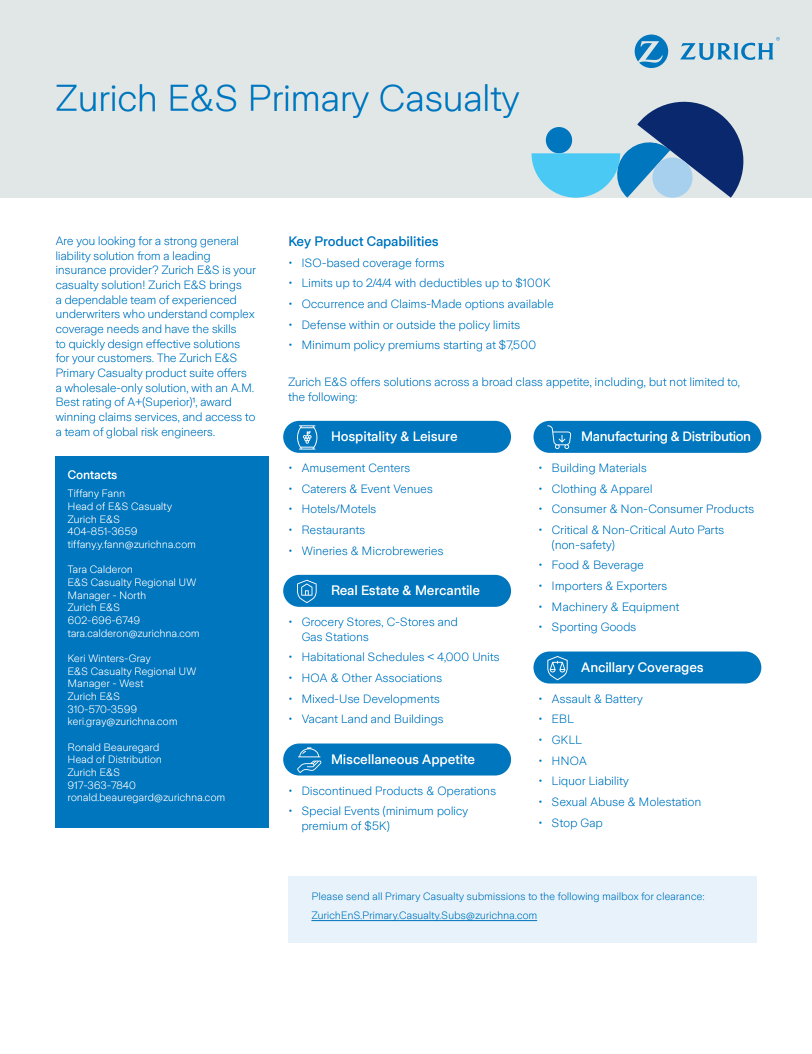

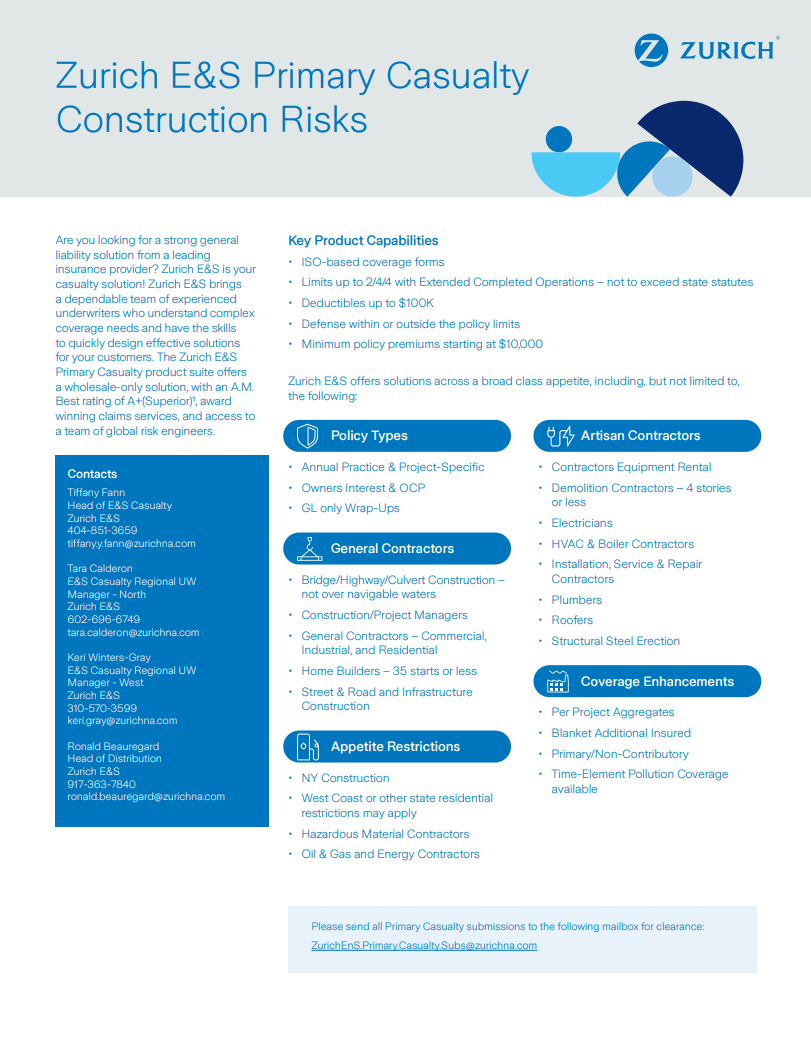

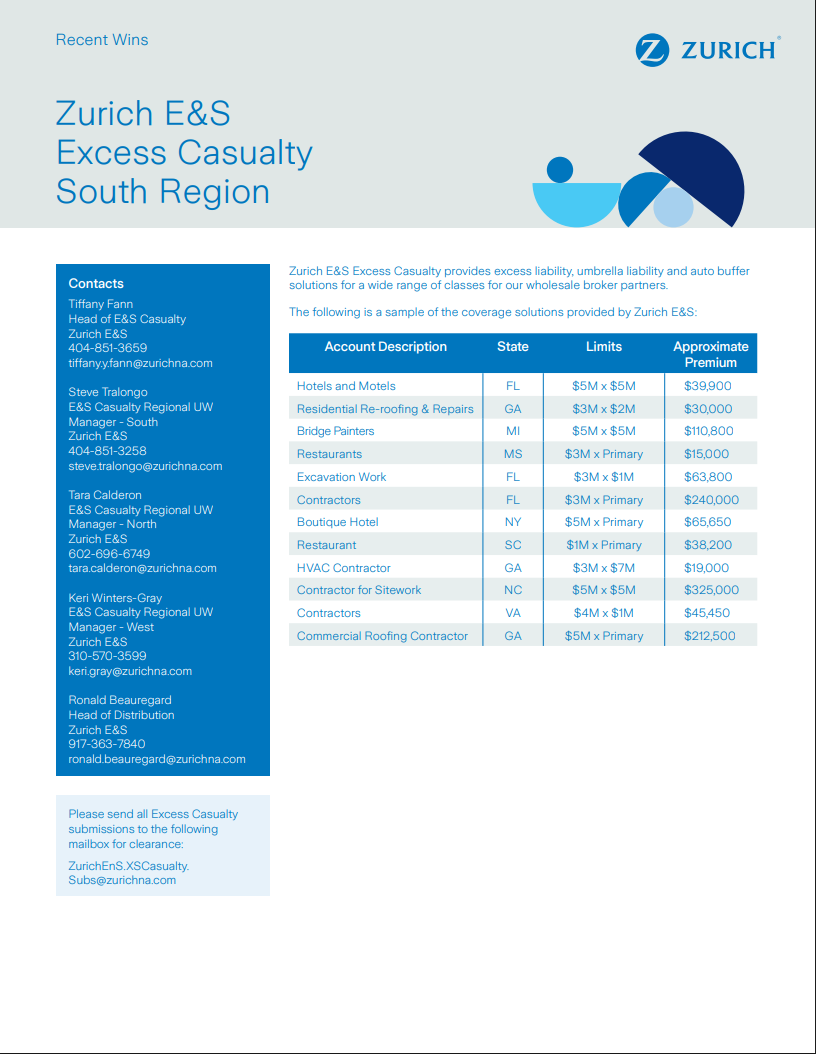

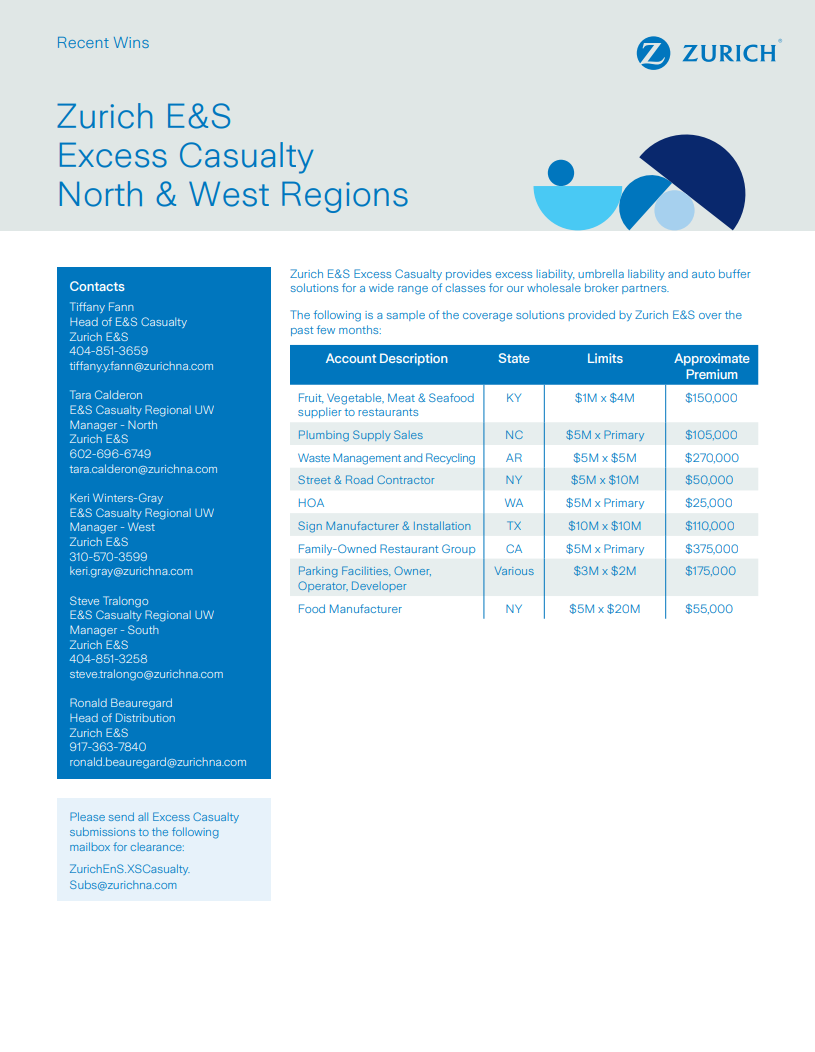

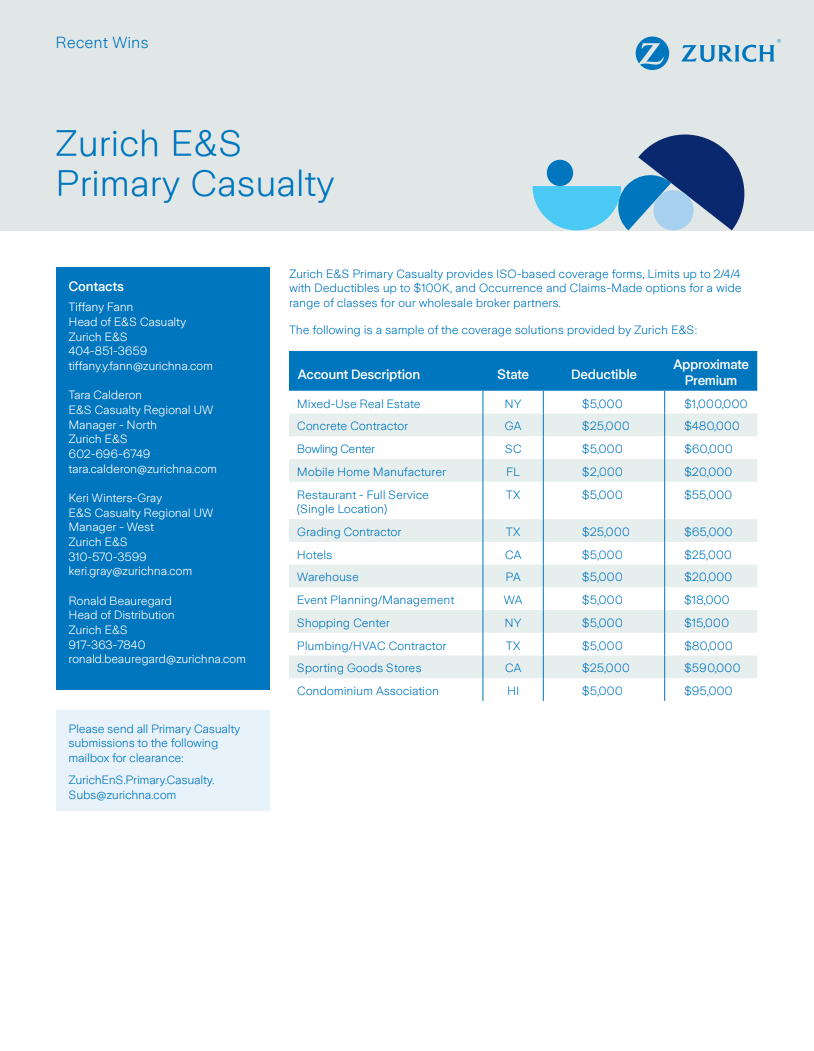

Zurich E&S Casualty, is a market 100% dedicated to servicing the wholesale distribution channel, in creating individual risk solutions. Zurich E&S caters to a broad range of industry segments and most exposure sizes, demonstrating adaptability and customer-centric approach. Zurich E&S Excess and Primary Casualty understands the significant risks insureds face and can provide coverage options to support their risk management needs. Our Primary General Casualty capabilities include guaranteed cost programs ranging from first dollar to $100,000 deductible options. We also offer supported, ventilated, or monoline excess placement, with limits up to $25 mil depending on the attachment point.

Excess and Primary Casualty Resources

Key Benefits of Zurich E&S Casualty Insurance

Navigating the complexities of commercial liability requires solutions designed for unique needs. For wholesale distributors, understanding the options in primary and excess casualty insurance is essential for covering against significant risks. Zurich E&S offers specialized expertise and coverage options to help distributors face the future with greater confidence.

Already Appointed With Zurich?

Send your new business submissions to the email addresses below and CC your underwriter

Excess Casualty - ZurichEnS.XSCasualty.Subs@zurichna.com

Primary Casualty - ZurichEnS.Primary.Casualty.Subs@zurichna.com

FAQ

Both excess casualty and umbrella insurance provide extra liability coverage, but they are different. Umbrella insurance often covers more types of claims, even those not included in primary policies. Excess casualty insurance sticks to the terms of primary policies but offers higher limits.

1Admitted only applicable to Excess Casualty

2 Zurich’s financial strength rating as of March 6, 2025. A.M. Best’s and Standard & Poor’s financial strength ratings are under continuous review and subject to change and/or affirmation. For the latest Best’s Ratings and Best’s Company Reports (which include Best’s Ratings), visit the A.M. Best website at www.ambest.com. For the latest Standard & Poor’s ratings, visit the S&P Global Ratings website at www.spglobal.com. The ratings represent the overall financial strength of the individual member companies of Zurich in North America, including Zurich American Insurance Company, and is not a recommendation of the specific policy provisions, rates or practices of each issuing insurance company.